-

We are an ISO certified company

-

Business Service Provider

We are an ISO certified company

Business Service Provider

GST is one of the biggest tax reforms in India.

REQUEST A CALL BACK

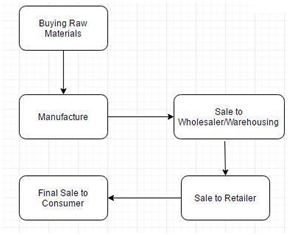

Goods & Services Tax is a comprehensive, multi-stage, destination-based tax that will be levied on every value addition. GST Registration is necessary for a business to comply with the Income Tax Department Norms. To understand this, we need to understand the concepts under GST definition. Let us start with the term ‘Multi-stage’. Now, there are multiple steps an item goes through from manufacturer or production to the final sale. Purchasing of raw materials is the first stage. The second stage is production or manufacturing. Then, there is the warehousing of materials. Next, comes the sale of the product to the retailer. And in the final stage, the retailer sells you – the end consumer – the product, completing its life cycle. Businesses which are dealing with good and services must apply for GST Registration Online.

Companies which are going to file GST Registration need to know about the type of taxes in GST. When Goods and Services Tax is implemented, there will be 3 kinds of applicable Goods and Services Taxes.

| Transaction | New Regime | Old Regime | Comments |

|---|---|---|---|

| Sale within the state | CGST + SGST | VAT + Central Excise/Service tax | Revenue will now be shared between the Centre and the State. |

| Sale to another State | IGST | Central Sales Tax + Excise/Service Tax | There will only be one type of tax (central) now in case of inter-state sales. |

Choose The Right Plan For You!

Congratulations! You won an Opportunity to Get the Expert Advice for 100% FREE !

CONTACT USWhat Makes Us Different From Others?

The licenses registered by us are 100% genuine and are issued by Government of India. However, we will provide you with all the validation, bills and receipts of each submission. Feel free to enquire!

We take full responsibility for our work and will issue you the licenses within the committed time period. Our team understand your problems and will provide full support in order to do the best for our valuable clients.

Don’t worry about the cost of submissions. We are here to provide you with the best at the best possible price. Need a discount? Contact our Sales team today!

GSB Taxation works at a National Level. We have a strong and dedicated team which works in all the 29 States of India.

Our consultancy provides more than 75 services which help in completing the entrepreneur dream of each individual.

We are here to help you! Our strong passionate team and connectivity lead in the completion of the most difficult registrations without any hustle.

GSB is a Google Partner. Google Partners are tasked with helping businesses market their service or products online.

Google Certified

GSB is ISO 9001:2015 Certified by UK AS, a leading Certification Body recognized worldwide.

UKAS ISO Certified

OUR OBJECTIVE:

We at GSB Taxation believe in high quality and exceptional customer service but most importantly, we believe helping others should be the primary purpose of a good service agency. So, we strive to give the best services at the most affordable prices. We’ve come a long way, so we know exactly which direction to take when supplying you with high quality yet budget-friendly services. Whether it is a Private Limited Company Registration, LLP Registration, One Person Company Registration or an FSSAI License Registration, we got it covered. We know that it’s hard for a person to stand on its own. He/she have to think twice before taking any step. Therefore, GSB Taxation offers all of these and other major services with excellent and friendly support in order to do the best for you. We are here to help you in nourishing your business. Trust our dedicated team get ready to live your dreams with us.