Regulation of NBFC Registration :

We are an ISO certified company

Business Service Provider

REQUEST A CALL BACK

NBFC or the Non-banking financing corporation brought the revolution in the banking as well as the financing sector. But we must note that after the immense growth over a decade the sector has shown signs of slowing down. It is because of the fiscal interest rate and the budgetary deficiency and also because of the fact that the costs of borrowing lending. And all this coupled with the liquidity issues. Moreover, because of the intense competition also the NBFCs are not able to perform in the recent years.

Also, note that the rise of credit co-operative societies in the recent years has also affected the NBFCs, they have been crushed because people generally flock to the credit co-operative society for loans and advances. They offer far flexibility to their clients than the NBFCs Also already suffering NBFCs have a new problem to worry about i.e. of NPAs (Non-performing Assets). It is also because of these many reasons that the NBFCs stocks have been on a free-fall. The kind contagion then spreads into the stock markets too.

It is because of these many reasons that NBFCs have come to a turmoil state and are being supported by the various grants from the governments. Although, some of them have been converted into banks but still their books are full of NPAs which cannot be easily solved. The crisis of NPAs has not been solved.

Even though the NPAs are a suffering lot still we see that there are many bottlenecks in their path. We see that there are many bottlenecks but then also NBFCs are the best financing corporations that the Indian economy has ever seen. They have played a huge role in the financing of the Indian Economy. They are the building blocks of the whole economy as well as the investment sector.

Even today, also if one wants to get an entity started, which is not a bank one thinks of the NBFC (Non-banking financial sector). Still we see that in the modern world the NBFCs are one of the most sought-after entities for starting a non-banking entity for borrowing and lending.

A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of nature, leasing, hire-purchase, insurance business, chit business. This does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property. A non-banking institution is a company and has a principal business of receiving deposits under any scheme or arrangement in one lump sum or in instalments by way of contributions or in any other manner is also a non-banking financial company (Residuary non-banking company). The NBFC registration can be obtained in 90-120 days.Financial activity as principal business is when a company’s financial assets constitute more than 50 per cent of the total assets and income from financial assets constitute more than 50 per cent of the gross income. A company which fulfils both these criteria will be approved by RBI for NBFC Registration. The term 'principal business' is not defined by the Reserve Bank of India Act. The Reserve Bank has defined it so as to ensure that only companies predominantly engaged in financial activity get registered with it and are regulated and supervised by it. Hence, if there are companies engaged in agricultural operations, industrial activity, purchase and sale of goods, providing services or purchase, sale or construction of immovable property as their principal business and are doing some financial business in a small way, they will not be regulated by the Reserve Bank. Interestingly, this test is popularly known as 50-50 test and is applied to determine whether or not a company is into financial business.

NBFCs lend and make investments and hence their activities are kin to that of banks; however, there are a few differences as given below:

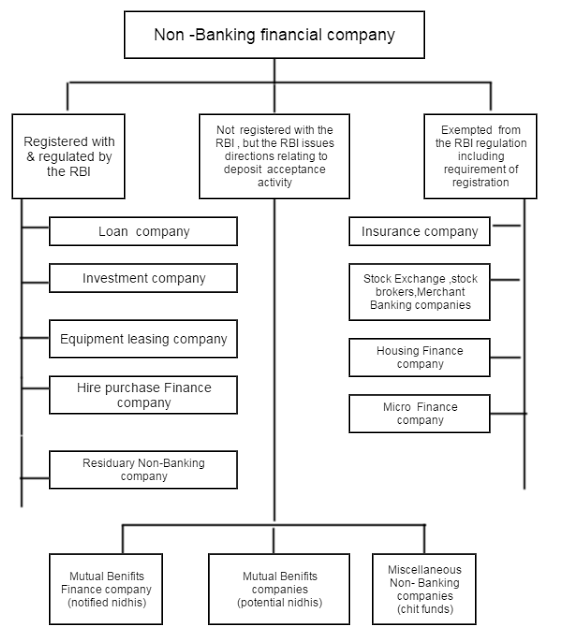

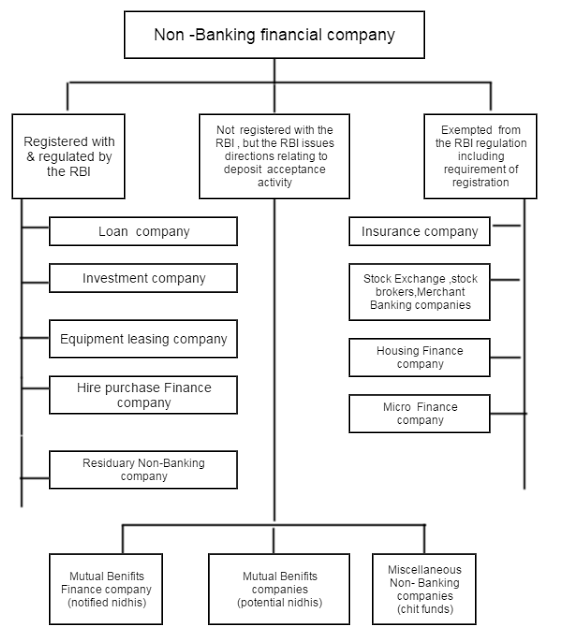

All NBFCs are either deposit-taking or Non-deposit taking. If they are non-deposit taking, ND is suffixed to their name (NBFC-ND). The NBFCs which have an asset size of Rs.100 Crore or more are known as Systematically Important NBFC. They have been classified so because they can have bearing on financial stability of the country. The Non-deposit taking NBFCs are denoted as NBFC-NDSI. Under these two broad categories, the different NBFCs are as follows:

Though the NBFC’s have been around for a long time, they have recently gained popularity amongst institutional investors, since they facilitate access to credit for semi-rural and rural India where the reach of traditional banks has traditionally been poor. NBFC’s have also had a major impact in developing small business in rural India through local presence and strong customer relationships. Usually, the loan officers in such NBFC’s know the end customer or have a strong ‘informal’ understanding of the credibility of the borrower and are able to structure their loans appropriately.

A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act that is engaged in the business of loans and advances, receiving deposits (some NBFC’s only), acquisition of stocks or shares, leasing, hire-purchase, insurance business, chit business. Therefore, NBFCs lend and take deposits similar to banks. In spite of this, there are few differences such as NBFC cannot accept demand deposits, NBFCs cannot issue cheques drawn on itself and NBFC depositors are not covered by the Deposit Insurance and Credit Guarantee Corporation.

The Reserve Bank of India regulates and supervises Non-Banking Financial Companies which are into the principal business of lending or acquisition of shares, stocks, bonds, etc., or financial leasing or hire purchase or accepting deposits. The principal business of financial activity is when a company’s financial assets constitute more than 50 per cent of the total assets and income from financial assets constitute more than 50 per cent of the gross income. A company which fulfils both these criteria must have NBFC license. This test for NBFC license is popularly known as the 50-50 test.Therefore, companies engaged in agricultural operations, industrial activity, purchase and sale of goods, providing services or purchase, sale or construction of immovable property as their principal business and are doing some financial activity in a small way, will not require NBFC registration.

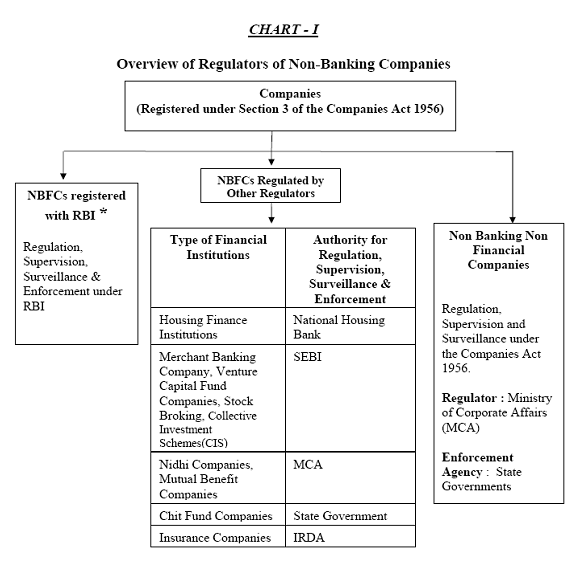

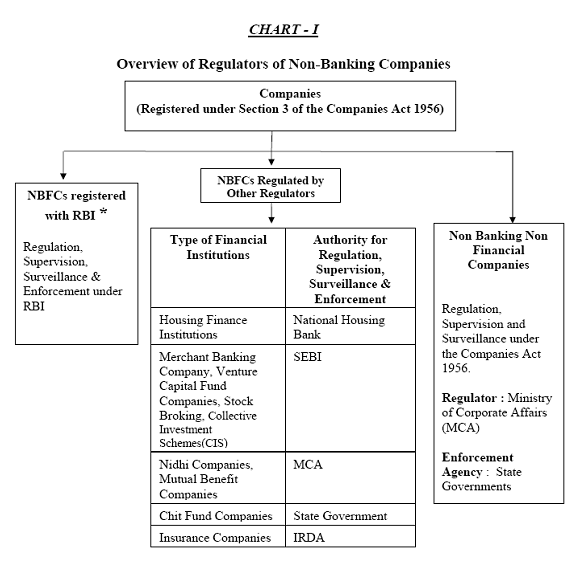

The following types of entities that are involved in the principal business of financial activity don't require NBFC License: Housing Finance Companies – Regulated by the National Housing Bank;Insurance Companies – Regulated by Insurance Regulatory and Development Authority of India (IRDA); Stock Broking – Regulated by Securities and Exchange Board of India;Merchant Banking Companies – Regulated by Securities and Exchange Board of India;Venture Capital Companies – Regulated by Securities and Exchange Board of India; Companies that run Collective Investment Schemes – Regulated by Securities and Exchange Board of India;Companies that run Collective Investment Schemes – Regulated by Securities and Exchange Board of India;Mutual Funds – Regulated by Securities and Exchange Board of India;Nidhi Companies – Regulated by the Ministry of Corporate Affairs (MCA);Chit Fund Companies – Regulated by the respective State Governments.The above types of companies have been exempted from NBFC registration requirements and NBFC regulations of RBI as they are regulated by other financial sector regulators.

To apply and obtain NBFC License, the following are the basic requirements:A Company Registered in India (Private Limited Company or Limited Company);It should be a company having minimum net owned funds of INR 2 Crores.The online application is available on RBI's website (COSMOS).Submission of hard copy of the application along with attached documents shall be submitted RBI Office. The NBFC license will be granted only after vigilant inspection of the application and documents attached with it.

Certified copy of Certificate of Incorporation issued by the registrar of companies.

Extract of the main object clause in the MOA clearly depicting the financial business.

The Audited balance sheet and Profit & Loss account along with directors & auditors report for the entire period of company's existence, or for last three years, whichever is less.

Copy of the certificate of Director's highest educational and professional qualification.

Copy of Director's experience certificate.

Any NBFC activity.

Accepting any public deposit.

Only the NBFCs which have been issued a license to accept a deposit in its certificate of Registration from RBI are allowed to accept public deposits. To ensure, NBFCs don't misuse the License issued by Government, there have been certain limits imposed and conditions specified, for accepting deposits by the NBFCs, which varies depending upon various factors.

Whether it is an Asset finance Company or Loan/Investment Company.

Based upon the Net Owned Funds of the Company.

Based upon the prudential norms as prescribed by the RBI.

Credit Rating.

Based on the combination of factors mentioned above, NBFCs are allowed to accept public deposits as a multiple of Net Owned Funds.

Q1. What is NBFC (Non-Banking Finance Corporation)?

Ans. A Non-Banking Financial Company is an institution which does not have a full license to advance loans and funds to sectors, industries or business entities i.e. they do not have a full-fledged banking license.

Q2. What are the documents required for the registration of an NBFC (Non-Banking Finance Corporation)?

Ans. The documents required for filing your NBFC license are: 1. Certified copy of COI 2. Extract of the objective clause in the MOA 3. Audited Balance sheet and Profit & Loss account along with directors and auditors report for the entire period of company’s existence. 4. Copy of the certificate of Director’s highest educational and professional qualification. 5. Copy of directors highest educational and professional qualification. 6. Copy of Director’s certificate. The documents required for getting registration from RBI (Reserve Bank of India): 1. Any NBFC activity 2. Accepting pubic deposit

Q3. What are the advantages of an NBFC (Non-Banking Corporation)?

Ans. Following are the advantages of an NBFC: 1. Hassle free credit facility 2. Good reach at the markets 3. Personal touch with client 4. Provide other facilities

Q4. What are the disadvantages of an NBFC?

Ans. Following are the disadvantages of a NBFC: 1. Cannot accept demand deposits 2. Cannot issue cheque drawn on itself 3. Regulatory mechanism is stringent

Q5. What are the different types of NBFC (Non-Banking Financial Corporation)?

Ans. The different types of NBFCs are following: 1. Asset Finance Company 2. Investment Company 3. Loan Companies 4. Infrastructure Companies 5. Systematically Important Core Investment Company 6. Infrastructure Debt Fund

Q6. How are NBFCs different from banks?

Ans. The NBFCs and Banks are following: 1. NBFCs cannot accept demand deposits 2. NBFCs cannot issue cheques to its customers as they do not form a part of the payment and settlement system. 3. As opposed to banks, NBFCs cannot avail the deposit of DICGC 4. They cannot issue demand drafts

Q7. At what rate of interest and for how long can NBFCs accept deposits?

Ans. The maximum interest rate at which an NBFC can accept deposits is 11 %. Further, the interest can be compounded or paid at rests longer than monthly costs.

Q8. What are the systematically important NBFCs?

Ans. NBFCs whose asset size is of Rs. 500 crore or more as per the last audited balance sheet are considered as systematically important NBFCs.

Q9. What are the returns to be submitted by the deposit taking NBFCs?

Ans. Following are the returns to be submitted by the deposit taking NBFCs: 1. NBS-1 2. NBS-2 3. NBS-3 4. NBS-4 5. NBS-6 6. Half-yearly ALM 7. Audited Balance sheet and Auditor’s report by NBFC accepting public deposits. 8. Branch into Return

Q10. Can NBFCs as trading member participate in the IRF market only for hedging or can also take trading position?

Ans. As per the guidelines, NBFCs wit asset size of Rs.1000 crore and above are permitted to participate in IRF as trading members.

Choose The Right Plan For You!

Congratulations! You won an Opportunity to Get the Expert Advice for 100% FREE !

CONTACT USWhat Makes Us Different From Others?

The licenses registered by us are 100% genuine and are issued by Government of India. However, we will provide you with all the validation, bills and receipts of each submission. Feel free to enquire!

We take full responsibility for our work and will issue you the licenses within the committed time period. Our team understand your problems and will provide full support in order to do the best for our valuable clients.

Don’t worry about the cost of submissions. We are here to provide you with the best at the best possible price. Need a discount? Contact our Sales team today!

GSB Taxation works at a National Level. We have a strong and dedicated team which works in all the 29 States of India.

Our consultancy provides more than 75 services which help in completing the entrepreneur dream of each individual.

We are here to help you! Our strong passionate team and connectivity lead in the completion of the most difficult registrations without any hustle.

GSB is a Google Partner. Google Partners are tasked with helping businesses market their service or products online.

Google Certified

GSB is ISO 9001:2015 Certified by UK AS, a leading Certification Body recognized worldwide.

UKAS ISO Certified

OUR OBJECTIVE:

We at GSB Taxation believe in high quality and exceptional customer service but most importantly, we believe helping others should be the primary purpose of a good service agency. So, we strive to give the best services at the most affordable prices. We’ve come a long way, so we know exactly which direction to take when supplying you with high quality yet budget-friendly services. Whether it is a Private Limited Company Registration, LLP Registration, One Person Company Registration or an FSSAI License Registration, we got it covered. We know that it’s hard for a person to stand on its own. He/she have to think twice before taking any step. Therefore, GSB Taxation offers all of these and other major services with excellent and friendly support in order to do the best for you. We are here to help you in nourishing your business. Trust our dedicated team get ready to live your dreams with us.